5 Things To Consider Before You Buy a Home Safe

Are you on the look-out for a good home safe to keep your home safe from ‘sticky fingers’?

Our homes contain many of our most valuable assets, not just the people we love but the most valuable possessions we own – our cars, our electronic gadgets (which are many these days!), wedding rings and other items of jewellery, and various documents such as passports. Perhaps you also keep an emergency stash of cold hard cash close to hand too. All of these things need to be protected from prying eyes, both when your home is occupied, and even more so when unoccupied, which is often the greater part of the day while you are at work.

Whilst you know only too well the benefits of having a home safe, before you rush out to buy one, it’s important to consider the features that your home safe needs to have. This will help you to budget appropriately and come home with a product that really meets your needs.

1. Safe Size

Make a list of all the things you plan to put in your home safe – will it contains keys, documents, jewellery, cash and so on? Do you also need to store larger items like guns or electronic equipment, when not in use? Once you have a clear list of the items that will go into your safe, it’ll be much easier to work out what size of safe you’ll need for your home.

2. Safe Cash Rating

Hopefully you have home and contents insurance. Check the fine print of your policy. Cash may be one of the items that you plan to put in your home safe, and these are available with various cash ratings. The cash rating refers to the amount of money that your insurance company will cover you to hold in your safe. Home safes start from £1,000 cash and go up to as much as £150,000 – however, we don’t recommend that you hold that amount of cash in your home safe (if you are lucky enough to have it in the first place!).

If you also plan to hold jewellery in your safe, typically multiply the value of the safe’s cash rating by 10. For example, if your safe has a cash rating of £1,000 you’ll be able to store jewellery and other valuables up to the value of £10,000 in it. Also, be aware that safes need to be professionally installed and fitted to meet the approval of most insurance companies, and this will be a factor covered in any claim application.

3. Safe Location

Which room in your home do you plan to locate your home safe? And where in the room will it be located? Your master bedroom is often recommended as a suitable place for your home safe for a few reasons. As you get changed before bed, a lady might take off her jewellery and a man might take his watch off and remove his wallet from his jacket or trouser pocket. If your safe is nearby, there’s a greater chance you’ll use it, but if you have to go back downstairs or to another room, you probably won’t bother!

Another benefit of being in your bedroom is that most night time thieves won’t want to take the risk of going into a room where you are sleeping for fear of waking you, but if your home safe is in a downstairs room or empty bedroom, it’s much more accessible.

Other location factors to consider include whether you’d like a hidden safe such as an underfloor safe or wall safe, and if the safe will be fixed to the wall or floor, or moveable. In some cases you may want to pick it up and move it to a different location in the home, but if you can move it, bear in mind that it can also be carried away by thieves!

4. Digital Home Safe or Key Lock?

The locking mechanism on your safe is another factor to consider. If you’re one of those people who is prone to losing your keys, a digital home safe may be a better option for you, and many of us are accustomed to using pin codes at ATMs or for your house alarm so it is often the preferred method. If you struggle to remember all your pin codes however, a key lock safe might be more for you!

Aside from the risk of losing the keys, the keys themselves tend to be long and awkward so are not ideal for putting in your pocket. They can also be costly to replace, and if a lost key results in the need to change the lock on the safe, well, that can prove to be very expensive! With a digital key lock, you won’t have keys to carry, you can easily change the combination and more than one family member can also have access to your home safe which can make life easier – but do limit the number of people with access to your home safe to be on the safe side!

5. Fireproof Home Safe

If you store a lot of documents (and even if you don’t), as a precaution a home safe that is also fireproof is a good idea. In the event of a fire, this will protect the contents from smoke damage or complete destruction. Most modern home safes offer 30 – 60 minutes fire protection for paper, and some brands will offer greater protection as well.

Hopefully these points will make it easier for you to choose the right home safe for your valuables, but if you have any further questions or would like to view some home safes, don’t hesitate to contact us.

The Best Home Safes you can Buy

Burton Eurovault Aver S2 Safe Series - starting from £175 for the Size 1K Model (£210 including VAT)

Eurovault Aver S2 Home Safe

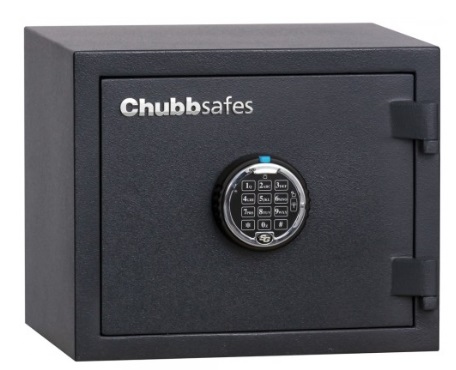

Chubbsafes Home Safe S2 Range - starting from £196 for the 10K Model (£235.20 including VAT)

Chubbsafes Home Safe

Burg Wachter Combiline Safe - starting from £239 for the CL 10K Model (286.80 including VAT)

Burg Wachter Combiline 10E Home Safe

For more information on which home safe to choose, read our article on 3 of the best home safes you can buy.